Setting up the Business Unit Due To Due From

The Business Unit Due To Due From setting is used when an association produces a separate balance sheet for each business unit and when there are scenarios of single payments, such as a single check, paying invoices containing revenue from two or more business units.

Note: This functionality is only necessary in certain re:Members AMS setups. Clients who have only one business unit will not use the Business Unit Due To Due From functionality.

Use Case: An association has two business units--one for the association and another for a foundation. A member pays an invoice of $100, where $70is for an event for the association, and $30 is for a session for the association foundation.

Without Due To Due From, this would appear as a debit of $100 for the association and a credit of $70 for the association, which is inappropriate.

With Due To Due From, the system knows that the $30 is actually in the association, which now owes the foundation $30. The association has a liability on its books with a credit of $30 owed to the foundation, and the foundation has an asset on their books of $30 as a receivable expected from the association.

First ensure business units are created and GL accounts are set up.

Tip: When creating Due To Due From GL Accounts, these should be Asset or Liability accounts.

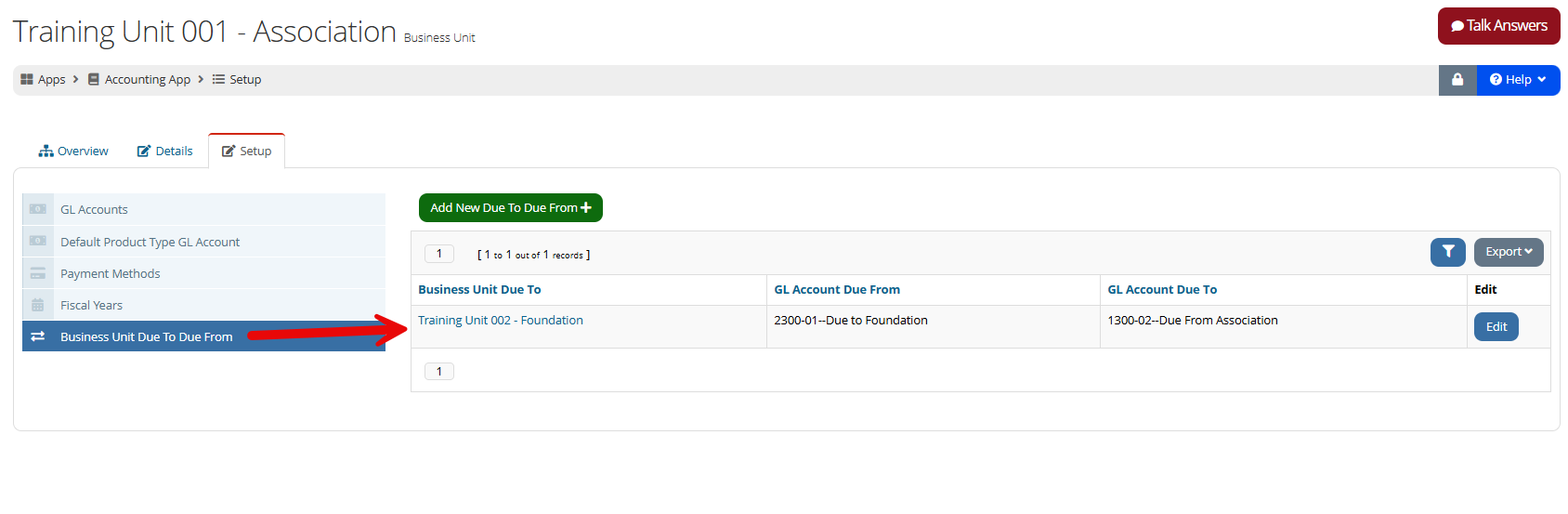

Example: In a scenario with an "Association" and "Foundation" business unit, in the Association business unit, a liability GL account could be created with the name "Due to Foundation," and in the Foundation business unit, an asset GL account could be created with the name "Due From Association." These GL accounts will be the ones selected in Step 4, below.

To set up the Due To Due From:

-

Navigate to the Accounting App > Setup > Business Units

-

Click Edit to open the main business unit for the association.

-

Click the Setup tab > Business Unit Due To Due From.

-

Click Add New Due To Due From. The Add Due To Due From form will appear.

-

The Business Unit Due From will auto-populate.

-

Select the GL Account Due From [...].

-

Select the Business Unit Due To.

-

Select the GL Account Due To.

-

-

Click Save.

Note: Once the Business Unit Due To Due From is set in the main business unit, the reciprocal of this connection will automatically be made in the Due To business unit.

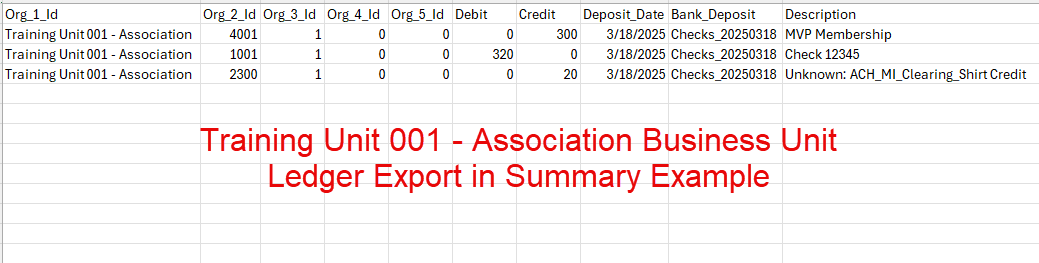

For customers exporting batch information to their accounting software, this information is included in the batch export file.

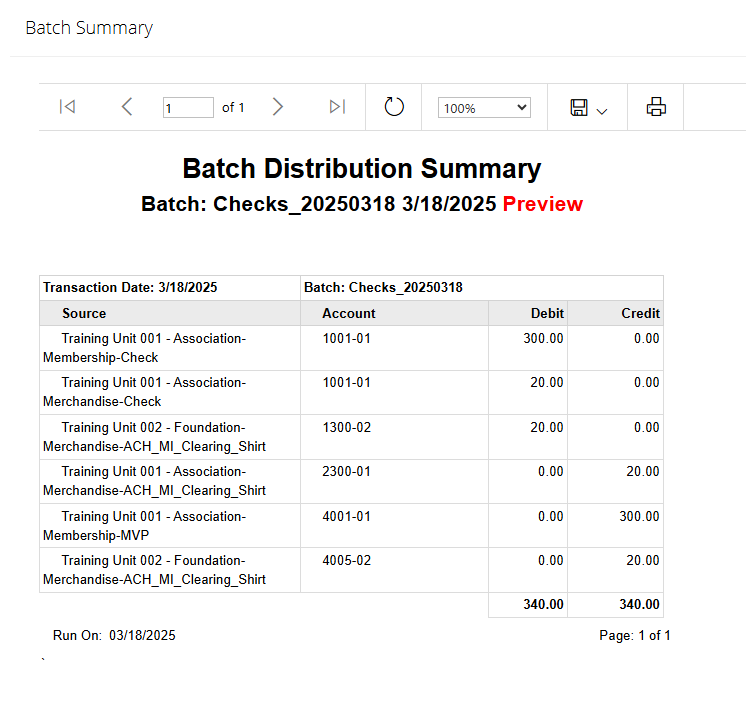

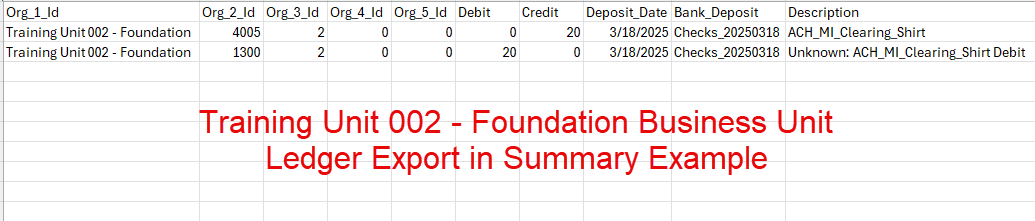

In the example batch pictured below, the purchase of a $300.00 membership and $20.00 t-shirt product, is recorded on the batch. The product price for the membership is associated with the "Training Unit 001-Association" business unit and the product price for the t-shirt is associated with the "Training Unit 002-Foundation" business unit for which a business unit due to due from is set up.

In this example, note that the system records the $20.00 t-shirt purchase as being debited from the business unit "Training Unit 001-Association" and credited to the business unit "Training Unit 002-Foundation."

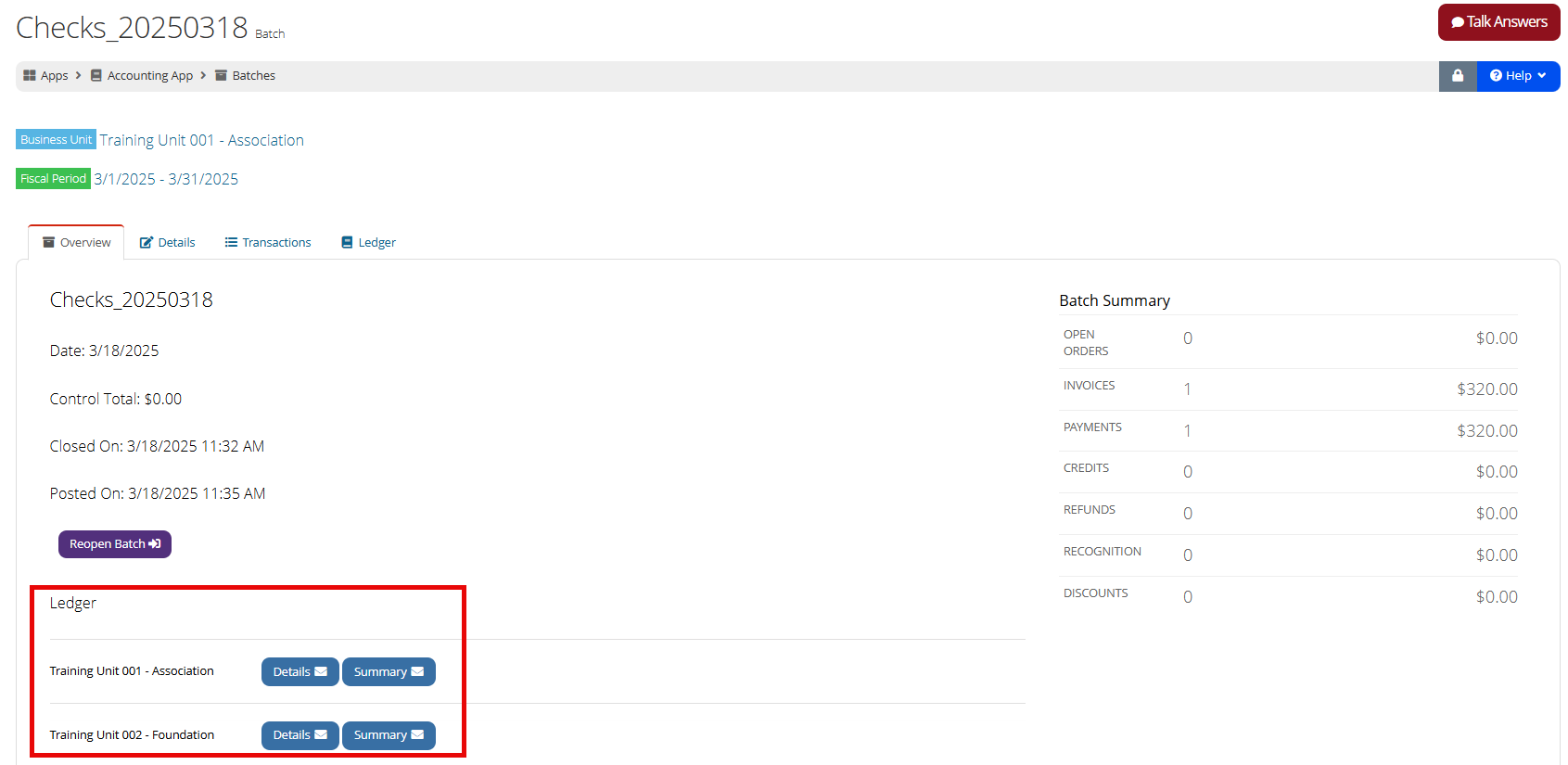

Once a batch containing these types of transactions is closed and posted, a Ledger Download area will appear on the Batch Record > Overview tab.

Staff can then select the business unit for the ledger to be downloaded and exported.

Important: The Due To Due From functionality can be applied to a main product with a related product so long as the products are in different business units, as well as if two invoices created from two different business units are being paid together. This functionality cannot be applied to a single product due to the fact that a price for a product can only be associated with one business unit.