Reconciliation in re:Members AMS

re:Members provides bookkeepers with transaction data necessary to recognize data in their accounting system. Several types of reconciliation are commonly done:

- Credit card reconciliation

- Cash/bank statement reconciliation

- AR reconciliation

- Deferred revenue reconciliation

- Credit reconciliation

Credit Card Reconciliation

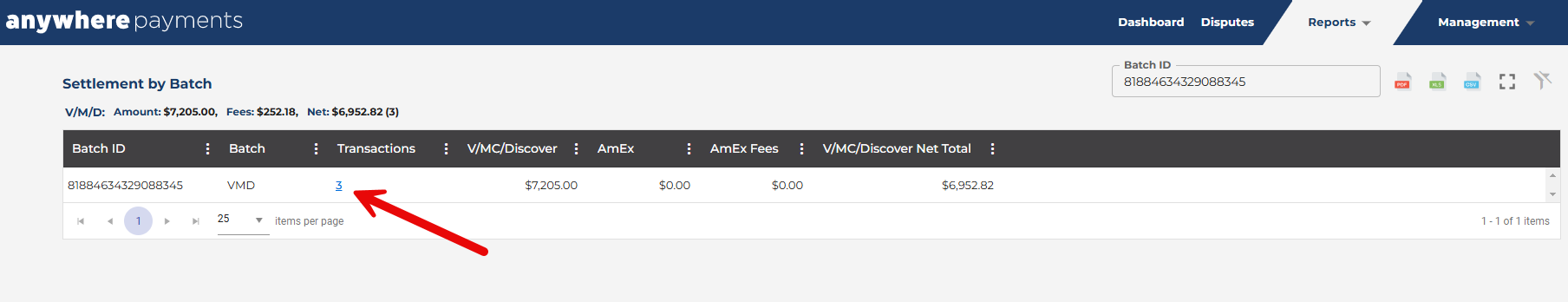

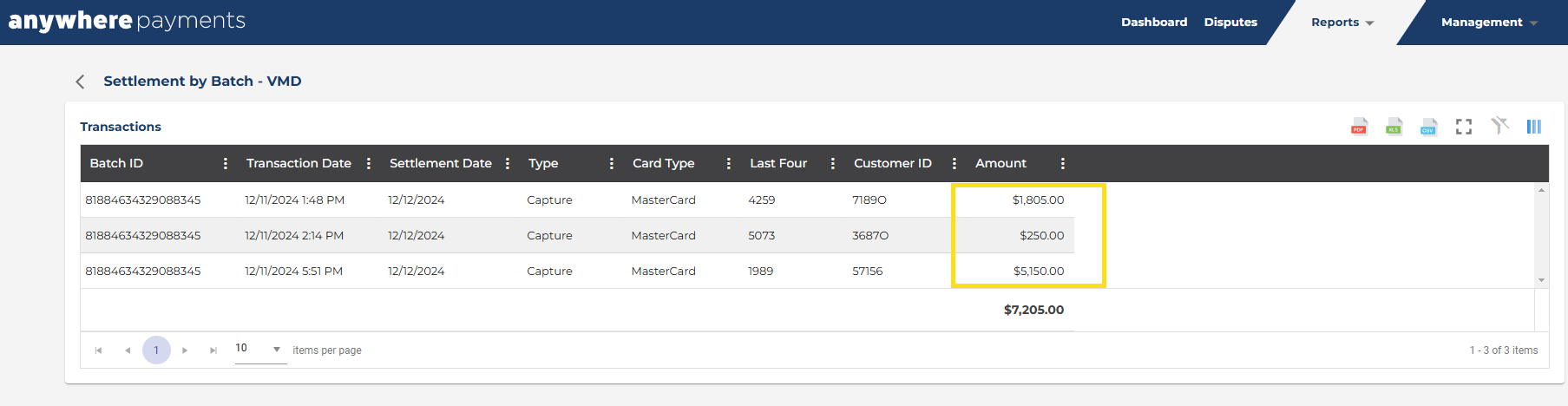

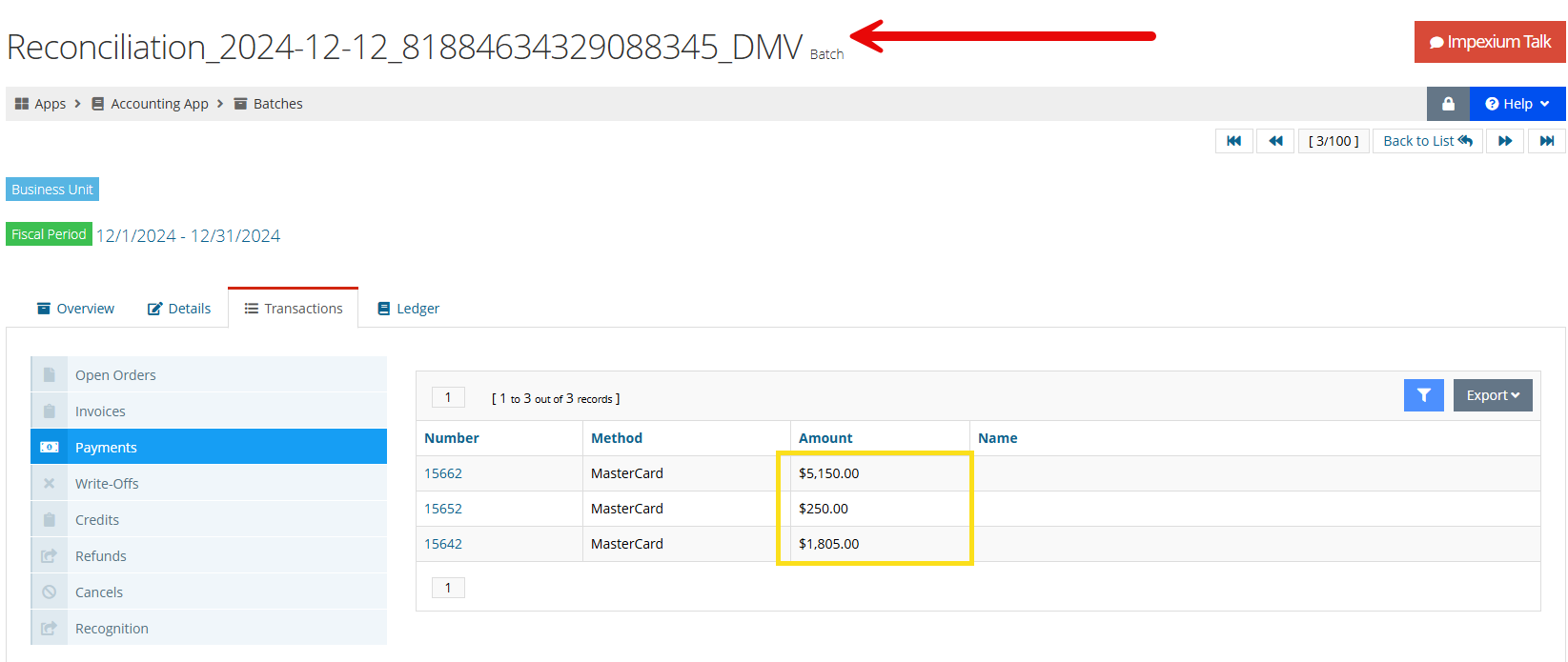

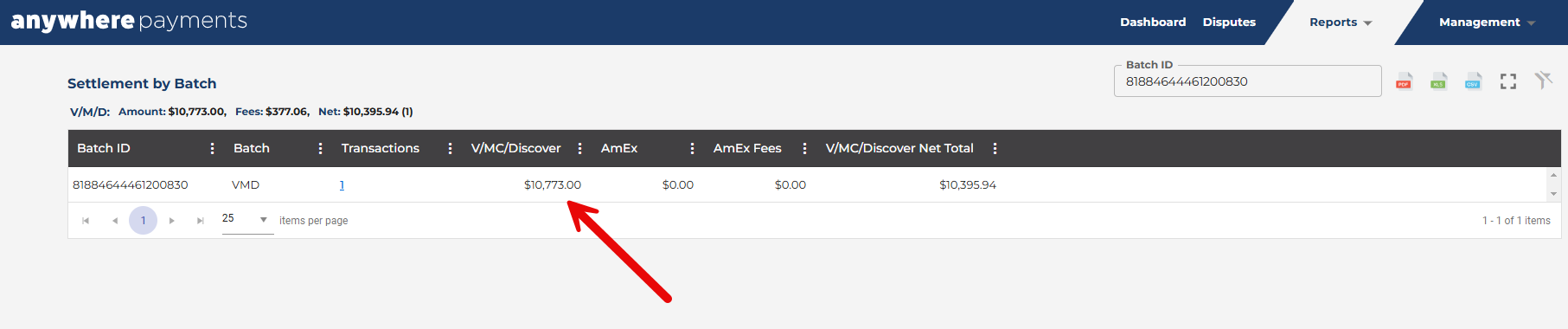

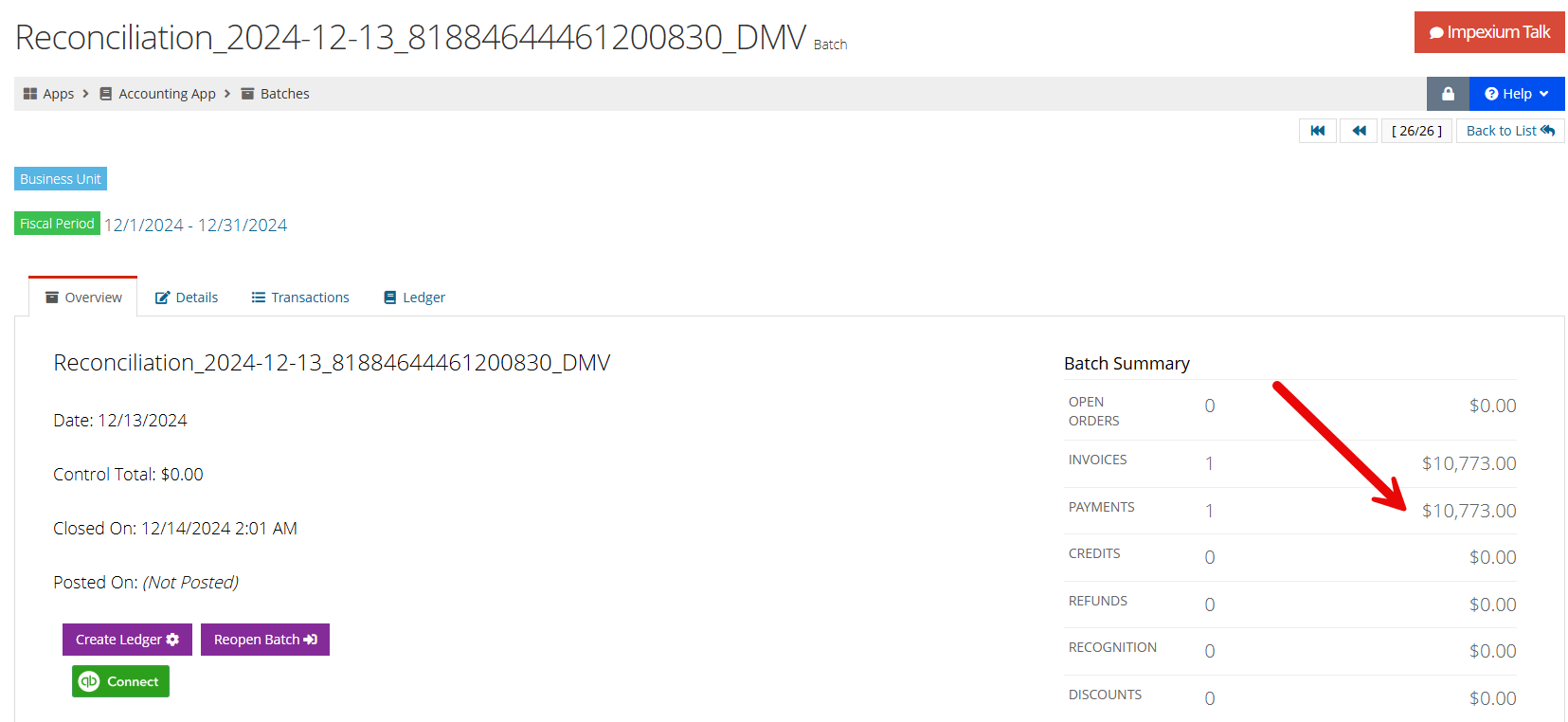

To complete credit card reconciliation, a bookkeeper must match credit card transaction reports from the credit card processor (Authorize.net, PayPal, BluePay, or APG) to one or two batches named "Reconciliation [X]" where [X] includes the settlement date, the processors batching id#, and either "DMV" or "A."

-

The reconciliation batch ending in "DMV" includes all settled, non-American Express credit card transactions.

-

The batch ending in "A" contains all settled, American Express credit card transactions.

The reason for two reconciliation batches is that most bookkeepers will have two deposits to the bank: one for American Express and a second for everything else.

Enabling & Running the Merchant Reconciliation Process

To begin credit card reconciliation, the merchant reconciliation process must be set up (a one-time configuration) and then scheduled to run.

Note: Not all merchant accounts can be reconciled. Depending on your setup with the processor, re:Members AMS may not be able to pull the settlement data each night. This is true with some configurations of Paypal.

Enabling Merchant Reconciliation

Follow these steps to enable reconciliation for each credit card merchant your system. This setup is done once, after which reconciliation can be run as often as necessary.

-

Navigate to the Accounting App > Setup.

-

Select the Merchants menu option.

-

Click Edit next to the merchant account.

-

Click the Enable Reconciliation check box.

-

Click Save.

Running Merchant Reconciliation

-

Under the All Jobs tab, locate the Accounting.MerchantReconciliation process and click Details.

-

In the Merchant Reconciliation Process Record, click the Schedules tab.

-

Click Add New Schedule. In the Add Schedule window,

-

Select how frequently the process should run (Now, Later, By Minute, Daily, Weekly, or Monthly).

-

Click the Schedule Process button.

-

-

After running the process, run the CC Reconciliation Report.

Verifying Merchant Reconciliation

The following automatically takes place as a result of reconciliation:

-

Once the credit card processor completes the nightly settlement to determine the credit card transactions that came in on a specific day, the Batch ID # and settlement report are created.

-

The re:Members AMS reconciliation process then refers to the credit card processor, determines every transaction settled for that day, and refers to the re:Members AMS batches to locate the credit card transactions that were settled.

-

A new reconciliation batch is created in re:Members AMS and the entire transaction from the original batch is moved to the reconciliation batch.

Staff will then complete the following:

-

Total payments in the reconciliation batch should match the total in the settlement report, and this is verified with the bank statement.

-

The re:Members AMS reconciliation batch must then be closed, posted, and exported to your accounting software. This should contain the same total amount deposited in into the bank.

Additional Reconciliation Scenarios

Below are other reconciliations that will need to take place in order to match up the activity in re:Members AMS with the bank statement.

Cash & Check Reconciliation

Cash and check transactions should go into a cash or check-specific batch. When the ledger is created, these transactions can easily be compared to like transactions on the bank statement.

Batches created for checks or cash should have the batch date set as equal to the date on which the funds were deposited into the bank.

Accounts Receivable Reconciliation

The AR Aging report is used to reconcile against the balance sheet created in your financial system.

This shows all invoices with a balance due as of the end of the month selected. The total balance on the report should agree with the AR account on the balance sheet.

Deferred Revenue Reconciliation

The Deferred Income report (found under the Accounting App > Reports) should be run monthly and saved as an Excel or .csv file.

Compare the total balance on the report with that on the balance sheet from your financial system.

Credit Reconciliation

The List of Credits report should be run monthly and saved as an Excel file or .csv file.

In the setup of re:Members AMS business unit / accounts, a liability account should exist for credits / overpayments. This liability account is used in the setup of price records. Whenever there is a cancellation of payments and a credit is created, this credit / overpayment account will be credited. The totals on this report can be compared to this "Credits / Overpayments" column on your financial system balance sheet.