Credit Card Chargebacks in re:Members

Chargebacks can occur when a customer disputes a charge with their credit card company due to an improper charge or fraudulent activity. If the credit card company investigates the transaction and determines the dispute should be resolved in the customer's favor, the company will do a chargeback and the customer will be issued a credit on their statement.

Accounting for the Chargeback in re:Members

Since chargebacks occur outside of re:Members, staff will need to manually update the system to reflect this action as the customer didn't actually pay off the invoice.

Note: At this point there has not been a transaction in the association's financial statements that would have taken money out of cash.

To account for the chargeback complete the following:

-

Open the Payment Record connected with the credit card payment.

The payment can be accessed from the Invoice Record, or by searching the Accounting App > Payments feature.

-

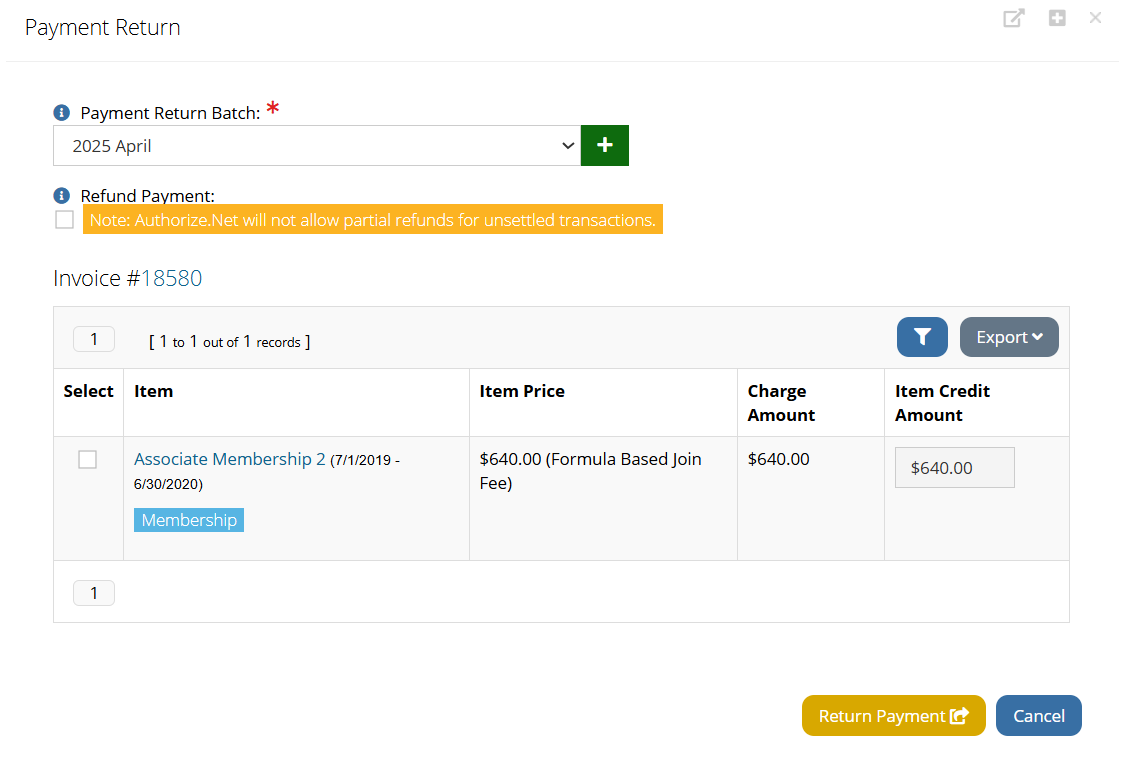

Click the Return button. The Payment Return form will appear.

-

Select the Payment Return Batch:

Tip: It is best practice to create a batch named "Chargebacks mmddyyyy". The Batch Date should be the date the chargeback is recorded at the bank or credit card processor.

-

Do not select the Refund Payment option.

-

Select the payment amount to return.

-

-

Click the Return Payment button.

Note: This action returned the payment, created a credit on the customer's account, and left the connected invoice intact along with the balance due. At this point, based on your practices, you can cancel the invoice or leave it with a balance due. For more on canceling an invoice, see Canceling an Invoice.

-

From the CANCELLED Payment Record, scroll down to locate the Credits section and click Details to open the Credit Record.

-

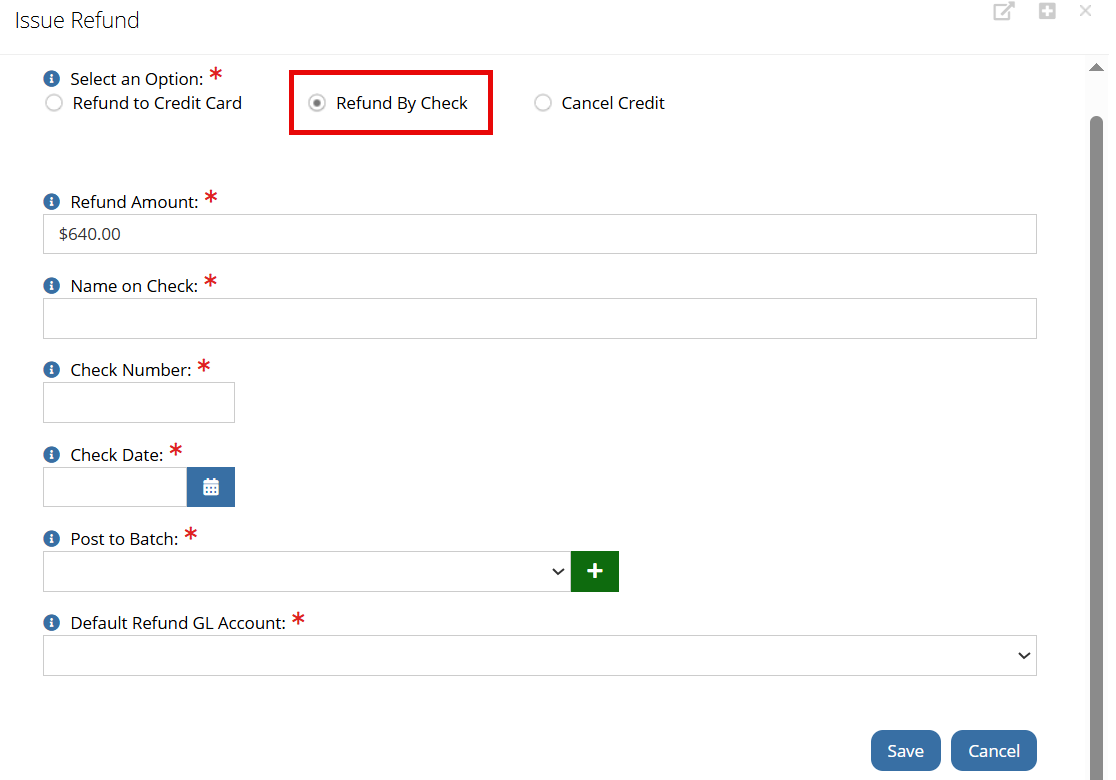

Click the Issue Refund/Cancel button. The Issue Refund form will appear.

-

Beside Select an Option, choose Refund by Check.

-

Complete the required fields.

Important: No check will be sent to the customer nor would a check be created within your accounting system, so the information recorded here is not specific to the customer. For Name on Check you could enter Chargeback. Check Number can be entered as 1 and the Check Date will reflect the date of the chargeback.

-

When selecting the Default Refund GL Account, choose the cash account to be credited.

-

-

Click Save.